The main worry is that if the company becomes insolvent the Director will be required by the liquidator to repay the amount owing to the company - ie 24000 in the above. Classification Of Bank Loans In The Balance Sheet.

To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet.

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

. Liabilities are a companys obligations amounts owed. I have one issue about the Dirctor Loan. Ad Simplify PL Creation.

22 Sep 2008 1 what does this item represent in a balance sheet. If you create this account under Account type of Current Liability you would only be able to post the amendments as General Journal. Some years ago companies used to lend money to their directors and just before the year end the directors would use bank borrowings to pay off the loan and reborrow it in.

In other words we. I took a loan of. Save Print Instantly - 100 Free.

I am filing my company accounts LTD Micor Entity. Ad Create Professional Balance Sheets Avoid Errors. Are owed as the result of a past transaction Are owed as of the balance.

On 01 April the remuneration committee decide to pay the 10000 to each director. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding amount and Average. The trial balance rolls up the information from the general ledger which includes all.

- Line 1 chose Directors Loan account and entered the loan amount. Liability accounts are accounts that show the amount of money that is owed by the business. Ad Simplify PL Creation.

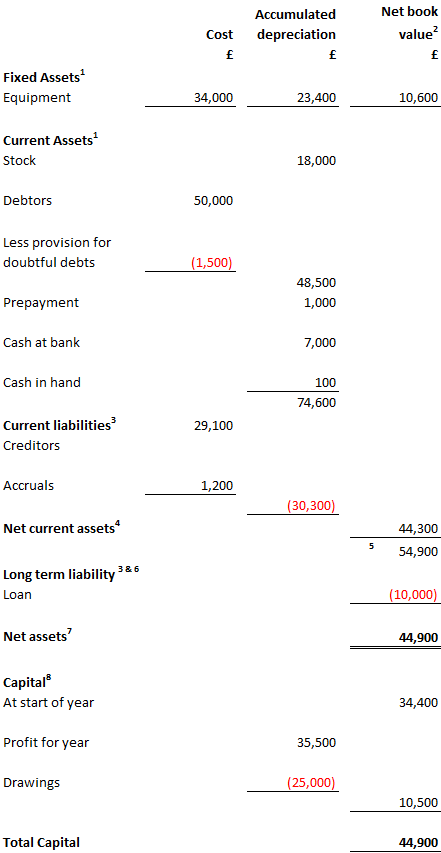

Answer Easy Questions Create Forms In Mins - Over 1M Forms Made - Export To PDF Word. AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. Company ABC has 3 executive directors and 2 non-executive directors.

However due to the. Companies are liable under section 455 of the Corporation Tax Act 2010 to pay a 325 tax charge on loans to directors and certain other individuals that are not repaid on a. The DL is paid back within 9 months after financial year end.

The director may loan the company 1000 to pay a supplier or cover. This seems madness to me. DEFERRED TAXATION The annexed notes form an.

A separate note receivable account should be created and named Due from Shareholder to separate this type of receivable from other receivables from the ordinary. Amount Owing To Director Definition - Chapter 2 Balance Sheet Concepts Assets Liabilities And Remember interest and penalties continue to accrue until youve paid your. Their amounts appear on the companys balance sheet if they.

The bank loans that are due in more than 12 months are recorded as the non-current liabilities of the business entity. If you would like to re. The DLA is a combination of cash in money owed to and cash out money owed from the director.

Balance sheet - amount due from directors.

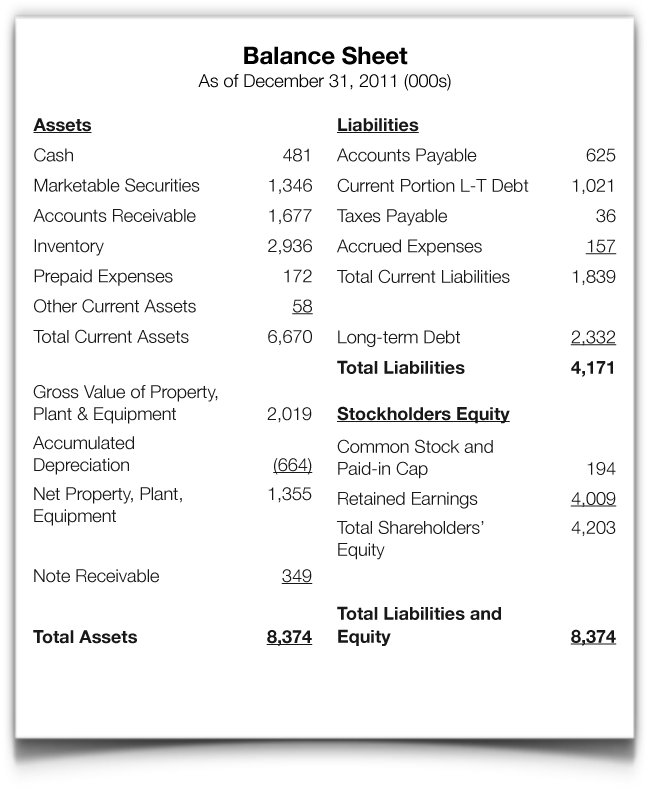

Balance Sheet Provides Insights For Debt Collection

The Balance Sheet Accounting 4 Business Studies Students

Understanding Company Accounts Corporate Watch

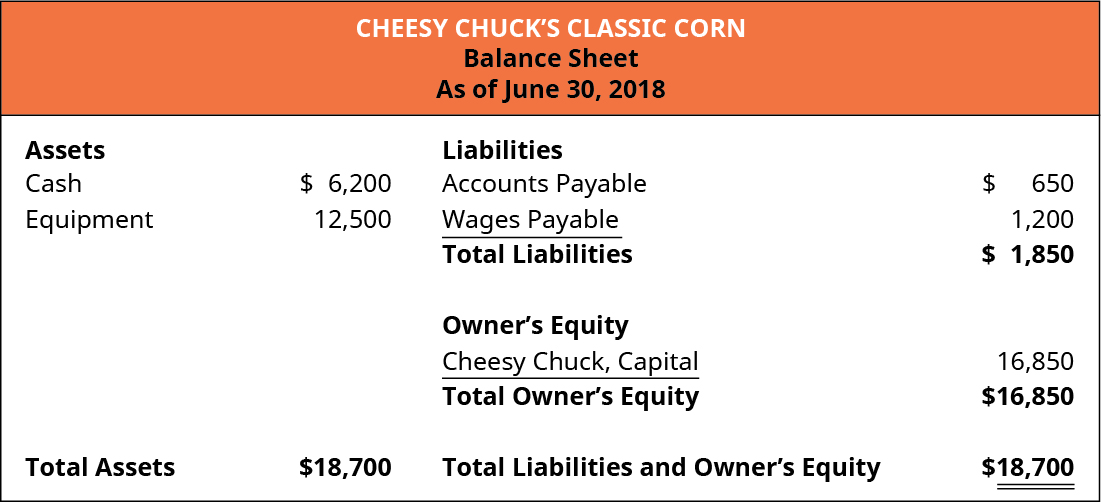

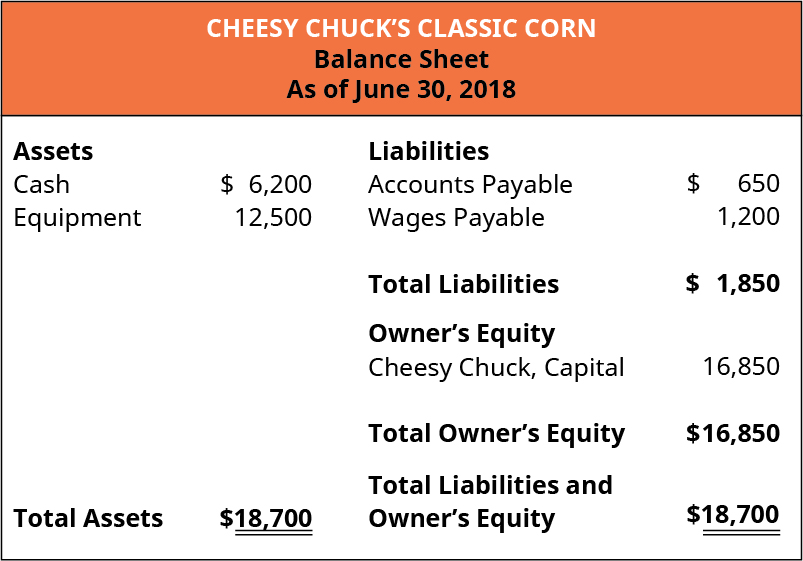

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Projected Balance Sheet Bowraven Limited Small Business Software Solutions

How To Read A Balance Sheet Complete Overview

Understanding Company Accounts Corporate Watch

Financial Statements 101 How To Read And Use Your Balance Sheet

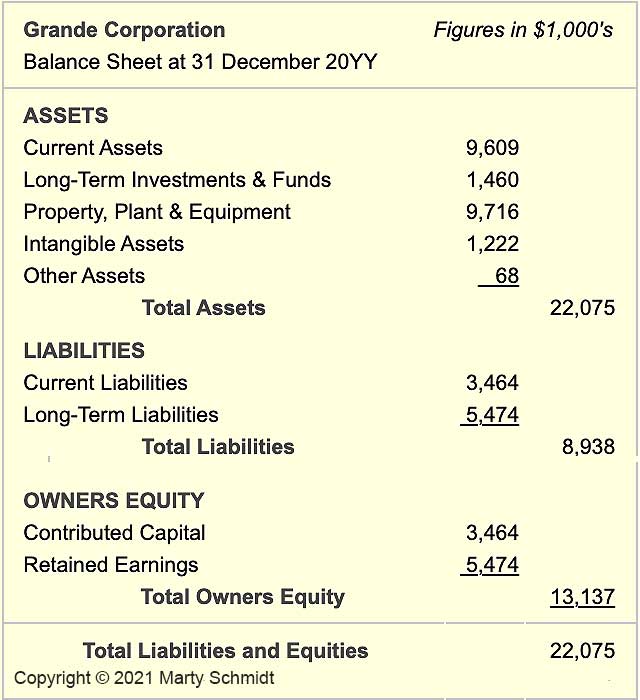

Owners Equity Net Worth And Balance Sheet Book Value Explained

Balance Sheet Example The Law Student Blog

Balance Sheet Explained Maslins Accountants Maslins Accountants

How To Read A Balance Sheet Complete Overview

3 Amount Owing To Directors The Amount Due To Directors Are Unsecured Interest Course Hero

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)